When you partner with EnableComp, you gain access to our industry-leading expertise and proprietary Intelligent Automation Platform to streamline the motor vehicle accident claims process and remove the burden of payment from your patients and institution.

Motor vehicle accident claims are the most complex of all complex claims. They pose a challenge from the moment a patient comes through your door. From determining liability and tracking down information to negotiating with payers and understanding intricate legal regulations — motor vehicle accident claims are a significant drain on your time and resources. And if you don’t get it right, you and your patient pay the price.

We are your “department down the hall” with the resources and infrastructure to get the most out of your motor vehicle accident claims — whether you’re a healthcare provider of one or a healthcare system of many.

With over two decades of experience in handling MVA claims, our team has the most expertise and tenacity to take care of this complex claim.

MVA claims are very labor intensive; there are phone calls, voicemails, wrong numbers, letters, and then more phone calls. Our MVA-dedicated revenue specialists engage with the patient and the payer — working every claim tirelessly from start to finish.

Legal expertise is essential to maximizing your MVA claims. Unfortunately, legal expertise is expensive. As a client, our in-house MVA/TPL Board-Certified Staff Attorneys manage the entire legal process to effectively appeal, negotiate, and recover payments on your behalf. We also work to limit liability from outside sources — making sure you won’t be a part of a class-action lawsuit.

Our attorneys are well-known within their legal communities. As a client, your dedicated attorney develops relationships that are positive for your organization. They stand firm and work on your behalf for all MVA cases.

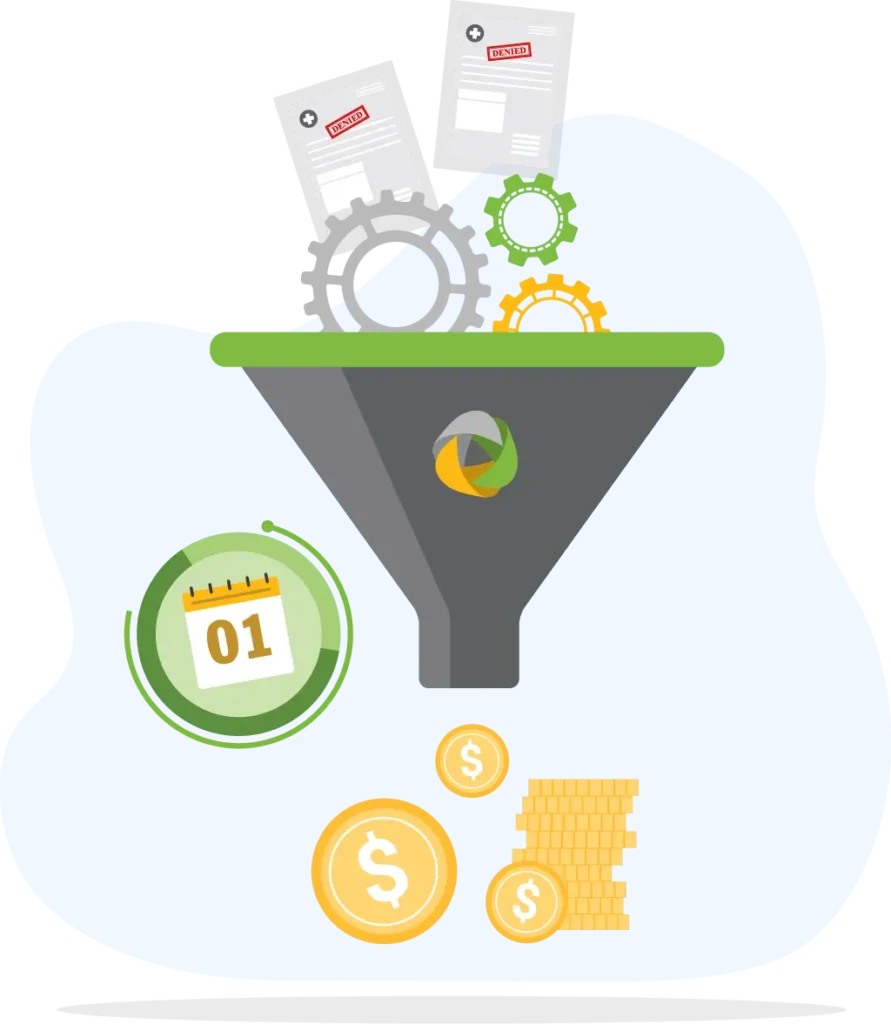

Our proprietary software platform, E360 RCM™, interfaces directly and securely with clearinghouses and your EHR/HRIS system — using RPA technology to automate workflows and ensure timely, accurate filing and adherence to state-specific laws.

Our Lien/Letter of Protection Program provides a customizable approach — helping you secure the highest possible payment for your institution.

We handle both hospital and physician-based MVA claims from registration to reimbursement. Our process covers all aspects of the MVA claim through all reimbursement classes including Medical Payments Coverage (Med-Pay), Commercial, Personal Injury Protection (PIP), and Third-Party Liability (TPL).

Based on your organization’s priorities.

Proprietary Discovery Solution

We utilize extensive foundational intelligence to validate coverage and confirm expected reimbursement.

Preparation

Automation-enhanced estimation and accuracy checks for required data and supporting documentation prior to sending to the payer.

Timely Filing

Bill is packaged and submitted electronically, when possible.

Lien Filing

Liens are filed, where applicable, in a timely manner to secure your interest in any potential settlement.

Follow-Up

Aggressive follow-up and process monitoring.

Status Documentation

Notes updated daily to ensure visibility into the status of every claim.

Payment Review

Underpaid items are identified automatically and appealed.

Coordinated Benefits

When an MVA policy has been discontinued, we go through an analysis to confirm the discontinuation and then roll it over to the next potential payer.

Detailed monthly reporting based on pre-defined priorities to help you measure progress and reconcile accounts.

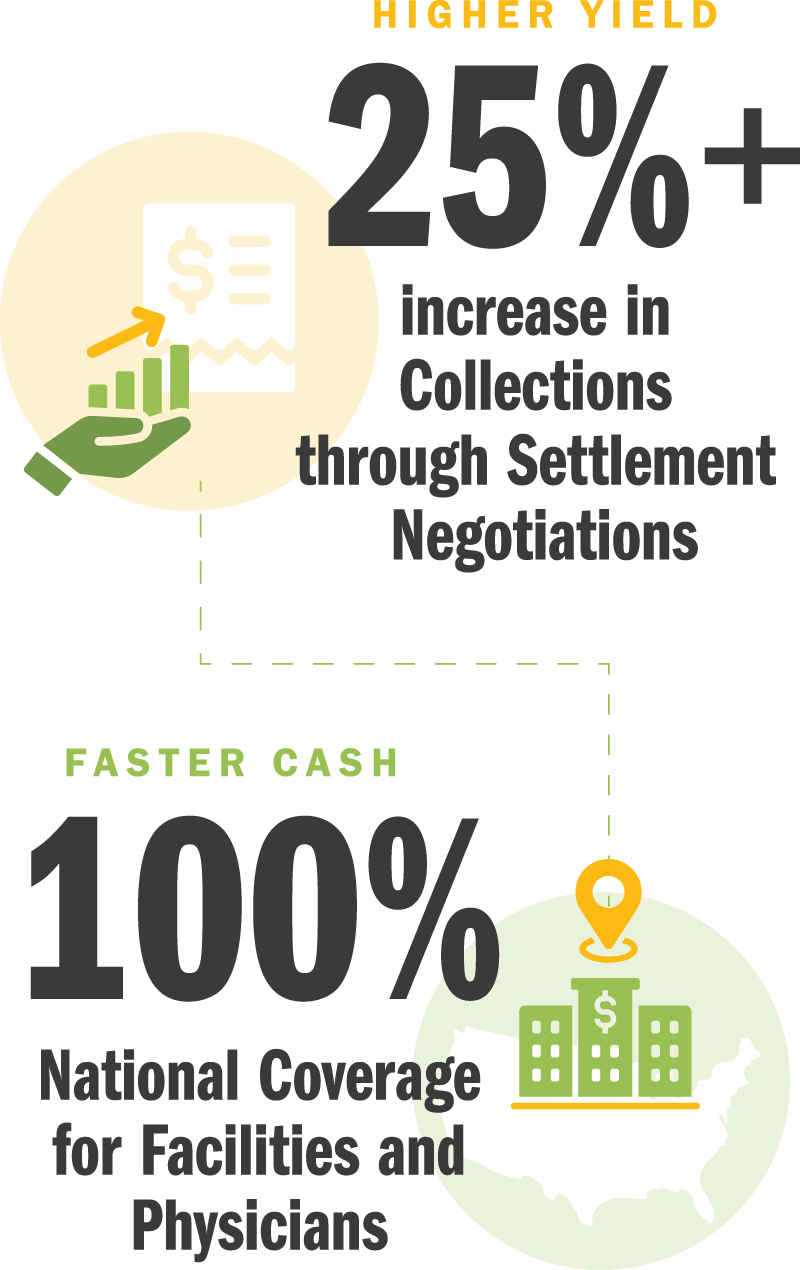

A comprehensive solution that works all of your motor vehicle accident claims from every angle for maximum impact and ROI. Ideal for providers who are ready to focus solely on higher-priority claim categories by outsourcing their motor vehicle accident claims.

Your Day One Solution includes:

We start on day one and work claims from registration to reimbursement for consistently accurate and timely payments.

We inherit your open claims and manage aging accounts to a successful resolution for improved queue management and inventory reconciliation.

We help you negotiate the best rate possible and determine whether accepting a payer’s discount proposal is in your best interest.

We identify and prevent denials — providing root-cause analysis and reworking even the most complex claims to enhance revenue and yield.

It starts the moment a patient comes through your door.

Familiarity with state-specific laws and regulations is essential to getting paid for MVA claims.

Secure your rights to the settlement.

Our contract is always contingent on your results.

You’re in good hands with our team of legal experts, healthcare professionals, revenue specialists, and technology experts.

Our E360 RCM™ platform interfaces directly and securely with your EHR/HRIS system.

With seamless integration and service, all you’ll see is the boost to your bottom line.